Accessory Dwelling Units

Custom designed ADUs that maximize your property value while providing flexible living solutions.

ADU Basics

Start Here to Learn about ADUs in Los Angeles & Ventura County

Just starting to think about building an accessory dwelling unit (ADU) on your property in Los Angeles or Ventura County? You probably have a lot of questions…

What is an ADU? Is an ADU the same thing as a granny flat, casita, guest house, in-law suite, or backyard cottage? What can I build on my property, and where? How do I begin the process? Should I talk to an architect or a contractor first, or maybe start with financing? How much will an ADU cost?

We're here to guide you through the basics! Start with this overview to familiarize yourself with key terminology and understand what California laws require local governments to allow when it comes to ADU development.

What is an ADU?

In construction and real estate, an ADU (Accessory Dwelling Unit) is a secondary housing unit located on a property zoned for single-family or multifamily residential use. These units can be detached from the main home (like a new stand-alone structure in the backyard), attached (such as a garage conversion), or part of the existing home (like an upstairs unit). ADUs typically include a full kitchen, a bathroom, and a private entrance.

Often called "granny flats," "in-law units," or "backyard cottages," ADUs have become a popular solution to urban housing shortages. These compact, efficient homes offer property owners a flexible way to optimize their space. ADUs can serve as additional living quarters for multigenerational families, a source of rental income, or even a comfortable space for guests. They are also ideal for use as a home office, studio, or hobby space, particularly for those who need more room than the main house provides. This versatility not only enhances the value of the property but also helps increase housing options within the community, addressing broader housing needs.

How many ADUs Can I Build?

Understanding the number of units allowed on your property

In California, ADUs can be built on residentially zoned lots, whether single-family or multifamily, as long as there is an existing primary dwelling unit on the property.

Single-family properties are allowed to add both an ADU and a Junior ADU (JADU). Multifamily properties can add as many ADUs as there are existing units on the property, up to a maximum of eight starting in 2025 (thanks to SB 1211). Additionally, multifamily properties can convert non-habitable spaces, such as garages or storage areas, into ADUs. In the City of Los Angeles, even more ADUs may be possible through the ADU Bonus Program, allowing for further expansion of housing options.

What types of accessory dwelling units are there and where can you add ADUs?

ADUs offer a range of design and construction options, providing homeowners with flexibility to meet their specific needs. You can build a detached ADU, a stand-alone structure that offers completely independent living space on your property. Alternatively, an ADU can be attached to your existing home, functioning as an addition or expansion. Another option is to convert existing spaces, such as a garage, into a fully functional living area. These versatile choices allow homeowners to select the type of ADU that fits best with their property layout. Keep in mind that each jurisdiction has its own regulations governing what can be built, so it's important to check local city guidelines here.

Detached ADU

Add a detached ADU to create additional living space that is completely separate from your main home. Keep in mind that each city has specific regulations regarding setbacks, which dictate how far the ADU must be from property lines and the existing residence. Be sure to check local requirements to ensure compliance.

Attached ADU

You can opt to expand your main home by adding an attached ADU, seamlessly integrating it with the existing structure. However, this option can bring some added complexity, as construction will need to account for the current building's layout and condition.

Conversion

Another option is to convert an existing structure, such as a garage or other building on your property, into an ADU. This approach repurposes the space to create independent living quarters, which may either be attached to or separate from the main home, offering a practical and efficient way to maximize your property's potential.

Considering Attached vs. Detached ADUs

Finding the right option for your property and lifestyle

As you start the process of adding an accessory dwelling unit (ADU) to your property, it's important to think about how different ADU styles can influence your living space and lifestyle. Each option has its own advantages, whether you're looking for guest accommodations, rental income, or space for multi-generational living.

Check your City's ADU Regulations

While new statewide ADU laws have made it easier to add an ADU in Los Angeles, each municipality still has its own unique requirements. Properly scoping and preparing your ADU project with these regulations in mind can make the difference between a smooth, quick permit process and a lengthy, expensive experience with resubmittals and additional fees.

ADU Laws in California

Over the past few decades, California has passed several laws promoting ADUs as a housing solution, making it significantly easier to add accessory dwelling units.

These state laws set a baseline for local regulations, with some cities sticking to the minimum requirements, while others, like Los Angeles, have adopted even more ADU-friendly policies.

What are the new ADU laws in California?

Size & Reduced Setbacks

There is no minimum lot size requirement for ADUs in California. Local municipalities are required to allow at least an 850 sq. ft. one-bedroom or a 1,000 sq. ft. two-bedroom ADU with only 4-foot side and rear setbacks, and many cities permit units up to 1,200 sq. ft. Additionally, an 800 sq. ft. ADU must be allowed "by right," even if it encroaches on front setbacks or exceeds floor area ratio (FAR) limits.

Lower Permitting Fees

Many impact and development fees for ADUs have been waived, and certain remaining fees can be reduced by understanding key square footage thresholds that trigger higher fees (e.g., 500 sq. ft., 750 sq. ft., 1,000 sq. ft.). Additionally, some cities offer further fee waivers to support ADU development.

No Owner Occupancy

Owner occupancy requirements for ADUs have been removed, allowing you to add ADUs on rental properties. Recent state regulations have permanently eliminated the need for owner occupancy, making it easier to develop ADUs.

HOAs

HOAs (Homeowners Associations) and CC&Rs (Covenants, Conditions & Restrictions) cannot impose unreasonable restrictions on ADU development. We design ADU exteriors to seamlessly blend with the main home, ensuring they meet the required standards for exterior finishes.

Parking

Most parking requirements have been eliminated, with no parking needed if the ADU is within 1/2 mile of public transit or car share services. If parking is required, it can often be easily addressed by designating spaces on the driveway.

Application Review

Building departments are required to respond to ADU applications within 60 days, and many act even sooner. However, this doesn’t guarantee quick approval, as the overall permitting process typically takes between 2 to 8 months.

How much does an ADU in Los Angeles or Ventura County Cost?

We’re happy you asked! We believe in full transparency and are eager to dive into the numbers with you. Visit our ADU Costs page through the link below to get all the details on the complete costs for designing, permitting, and building an ADU in Los Angeles.

How long does it take to build an ADU?

The full process of designing, permitting, and building a new construction ADU typically takes 5-12 months, depending on the complexity of your design, your location, and site conditions. The design phase generally takes 1-2 months, permitting and plan check lasts 2-8 months, and the build-out takes 3-5 months (varying based on jurisdiction and unit size).

Ready to Start Your ADU Journey?

Let's discuss your ADU goals and explore the possibilities for your property.

Get Free ConsultationADU Costs

Understanding the Investment for Your ADU Project

Building an Accessory Dwelling Unit (ADU) represents a significant investment in your property that can provide substantial returns through increased property value, rental income, or additional living space for family members.

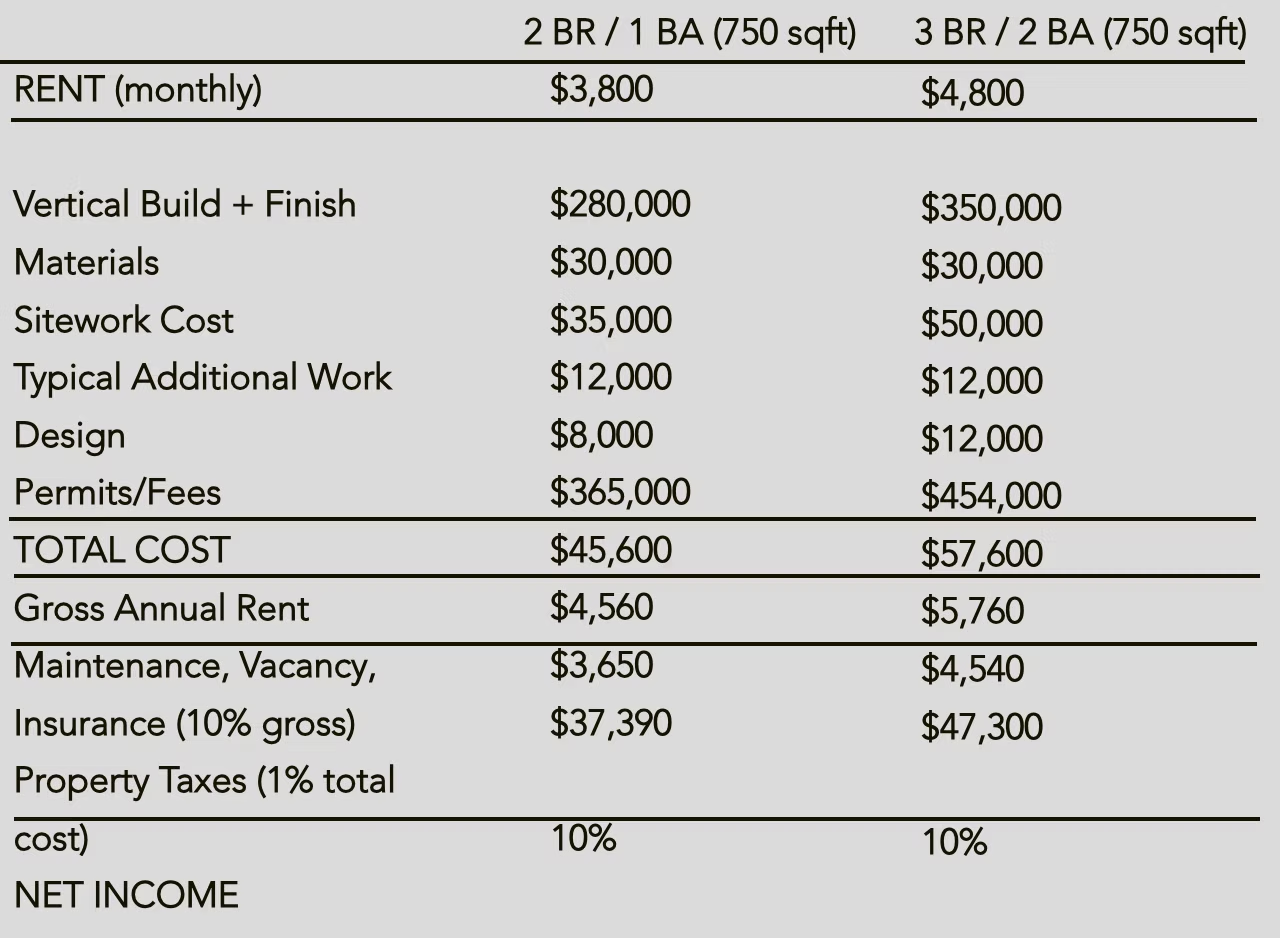

The cost of an ADU can vary widely based on factors such as size, type (detached, attached, or conversion), materials used, site conditions, and local permitting requirements. In the Los Angeles and Ventura County areas, typical ADU projects range from $300-$600 per square foot, depending on finishes and complexity.

Factors affecting your budget include foundation requirements, utility connections, design complexity, and interior finishes. Working with experienced ADU builders like Alto Builds ensures you'll receive transparent pricing and value engineering to maximize your investment.

ADU Cost Estimator

Estimated Total Cost

ADU Type

Include Finish Materials

How Much Does It Cost to Build an ADU?

For budgeting purposes, expect the cost of building a turn-key detached ADU to range from $350 to $500+ per square foot, for units between 500 and 1,200 sq. ft. Around 80-85% of these costs cover the vertical construction of the ADU, which includes the building itself and standard finishes.

To calculate the all-in cost for your ADU, be sure to include additional expenses for design (about $12K), permitting fees (around $2-14 per sq. ft., depending on the city), and typical site work (approximately $25K). You should also plan for $30-50K+ for utility upgrades and other property-specific requirements. At Alto Builders, we assess over 75 specific ADU factors for each property to provide an accurate breakdown of all costs related to your ADU build project.

The cost of building a detached ADU is primarily influenced by the unit's size, the number of units, site conditions (such as grading and utility locations), and local permitting requirements (like building plan checks, permitting fees, and school fees). Vertical construction costs will vary depending on the final finishes; our pricing includes a standard finish level, which covers appliances and fixtures. Learn more about our standard features.

Rising Construction Costs

It's important to note the recent rise in construction costs, which has caused sticker shock for many homeowners. The California Construction Cost Index (CCCI) increased by 37% between January 2021 and January 2024. This means that an ADU costing around $300,000 to build in early 2021 would now cost approximately $410,000 in 2024.

As of June 2024, our cost estimates for ADUs in Los Angeles have been updated to reflect these changes. Our goal is to provide a realistic understanding of the costs involved, so you aren't met with unexpected expenses later. For more information on our pricing approach and our price guarantee, check out our detailed pricing page. Being informed from the beginning helps you plan more effectively for your ADU project.

What's included in the cost of building an ADU?

Plans, Permits, & Fees

$10,000.00+

Owner occupancy requirements for ADUs have been removed, allowing you to add ADUs on rental properties. Recent state regulations have permanently eliminated the need for owner occupancy, making it easier to develop ADUs.

HOAs

HOAs (Homeowners Associations) and CC&Rs (Covenants, Conditions & Restrictions) cannot impose unreasonable restrictions on ADU development. We design ADU exteriors to seamlessly blend with the main home, ensuring they meet the required standards for exterior finishes.

Parking

Most parking requirements have been eliminated, with no parking needed if the ADU is within 1/2 mile of public transit or car share services. If parking is required, it can often be easily addressed by designating spaces on the driveway.

Application Review

Building departments are required to respond to ADU applications within 60 days, and many act even sooner. However, this doesn't guarantee quick approval, as the overall permitting process typically takes 3 to 8 months.

Why does it cost so much to build an ADU?

We often are asked why Accessory Dwelling Unit building costs seem higher when compared to a Single Family Residence (SFR) on a cost per square foot basis. In short, the answer is that SFRs are often twice the size of an ADU, resulting in a lower price per square foot. ADUs have a higher cost per square foot because they bear many of the same "fixed" costs of any residential building project.

Whether building an ADU or a SFR, there are certain base costs which occur no matter the size of the structure.

These include:

- • Design & Construction Documents: Relatively speaking, drafting hours and costs are in the same ballpark for an ADU or a basic SFR. An ADU still requires a full set of building plans… even pre-approved plans are not something you can walk into a building department as-is; they must be customized to your property.

- • General Conditions: Dumpsters, temporary toilets, project supervision, and site protection are required regardless of the build size and will be part of your ADU costs.

- • Kitchen, Bath & Laundry: Kitchens are the most expensive room of a building, including cabinets, countertops, plumbing & sink, plus appliances. Bathrooms and laundry facilities are also costly with plumbing & finish materials. A small one bedroom ADU still needs a kitchen and a bathroom, while a modest SFR might need just an additional bath yet support 4X the square footage.

- • Vendors: Whether a vendor is installing a small amount of material for an ADU or a large amount for a SFR, there is a base cost for simply showing up and setting up their tools.

Thus, there is a minimum base cost to build a residential unit, no matter how small the unit may be. That means that an ADU cost per square foot can be as high as $500+ for very small units.

Read more about how to compare ADU quotes. Looking to go a more DIY route to save money? Consider an unfinished shell ADU, where you complete the finish work yourself and save.

Get Accurate ADU Cost Estimates

Ready for transparent pricing and detailed cost breakdown for your ADU project?

Get Free ConsultationADU Financing

Financing an ADU project in California requires understanding your loan options, estimating project costs, and ensuring your financing plan covers the entire construction process. Whether you're building an ADU for rental income or to accommodate family, securing the right financing goes beyond just finding a loan—it's about making sure your loan matches the full, all-in costs of the build.

As an ADU design-build company, we often see homeowners caught off guard by unplanned expenses that weren't included in the initial budget. That's why having a clear, comprehensive budget is crucial when securing financing. The last thing you want is to lock in a loan only to discover it won't cover critical expenses like site work, permits, or utility connections.

This guide, built from a builder's perspective, is here to help you navigate the ADU financing process. We'll walk you through planning your budget for a successful build, reviewing various financing options, the steps to secure an ADU loan, and answering common FAQs. By understanding the full scope of your project and aligning your loan with your financial needs, you can avoid surprises and ensure a smooth ADU build from start to finish.

Budgeting for an ADU Project

Careful budgeting is essential for any ADU project to avoid unexpected costs during construction. By fully understanding all expenses—such as sitework, utility connections, construction, finishes, design, and permitting—you can ensure your project stays within your financial limits.

It's important that your ADU design fits your budget, not the other way around. Discuss any budget constraints early in the design phase to prevent expensive revisions later.

Begin with a rough estimate that includes both construction and pre-development costs like architectural designs, permits, and site preparation. This initial estimate will serve as a foundation for financing discussions. From there, refine the estimate through the Feasibility process, where your ADU builder will assess all potential hidden costs specific to your project.

Best ADU Financing Options

Home Equity Loan

A home equity loan, or HELOC, is usually the easiest way to finance an ADU, though current rates are higher than usual. For primary residences, Loan-To-Value (LTV) ratios typically range from 80-90%. For example, if your home is valued at $700K and your current mortgage is $400K, you could access a credit line of $160K (80% of $700K is $560K, minus the $400K loan balance). A home equity loan offers flexibility, as you can draw from the credit line as needed and are only charged interest on the amount you use.

Fixed Rate Second Position Loan

Want to keep your current mortgage rate? A newer loan product is available that's based on your home's value after adding the ADU ("after renovation value"). This option doesn't require refinancing your existing loan and offers terms up to 20 years. Unlike construction loans, there are no "draws," and you receive the full loan amount upfront. Once the renovation is complete, an appraiser will issue a certificate of completion. Learn more about fixed rate second position loan options.

Construction Loan

If you don't have significant home equity, a construction loan may be a great option for financing your ADU. This type of loan covers the construction costs and then converts into an adjustable-rate mortgage (ARM) once the ADU is complete, effectively refinancing your original mortgage. During construction, payments are interest-only, and no interest is due until funds are drawn as the project progresses. These loans are available for both owner-occupied and rental properties.

Renovation Loan (203K or Homestyle)

Renovation loans allow homeowners to finance a renovation project, including ADUs, as part of their mortgage. Fannie Mae Homestyle loans, for example, support the construction of detached ADUs and have a conforming loan limit of $977,500. These loans are often based on the "future value" of the property after the ADU is added, determined by appraisals (not rental income). Renovation loans typically offer up to 95% financing for a primary residence or 85% for an investment property. They can also be combined with a loan for purchasing a property.

Cash-Out Refinance

A cash-out refinance replaces your current mortgage with a new one that exceeds what you currently owe, giving you the difference in cash to fund your ADU construction or other renovations. You must have equity in your home to qualify for a cash-out refinance, with limits typically ranging from 80-90% of your home's equity. For example, if your home is worth $1M and you owe $600K, you could potentially refinance for $800-900K, leaving you with $200-300K in cash for your project.

Home Equity Conversion Mortgage (Ages 62+)

Also known as a reverse mortgage, an HECM allows homeowners 62 or older to borrow against their primary residence. Borrowers can access up to 42% of their home's value at age 62, increasing to 70% at age 86 or older. Any existing mortgage must be paid off with the HECM, and the remaining funds can be used for home improvements or investment properties. This loan operates as a line of credit with no fund control requirements, meaning no construction draws are necessary.

Calculate your Loan Amount here

Steps to Securing an ADU Loan

When securing financing for your ADU project, it's important to understand the loan process from start to finish. The following steps will guide you through obtaining an ADU loan, ensuring you have the necessary documentation and meet lender requirements.

1. Assess Your Financial Situation

Before applying for an ADU loan, evaluate your financial status. Check your credit score, gather income verification documents, and consult a financial advisor if needed. Understanding your financial health will help determine your borrowing potential and identify any areas for improvement before applying. This will also guide you toward loan programs for which you may qualify. If your family is helping with the ADU costs, consider reviewing our ADU Guide for Families for important title-related considerations.

2. Get Ballpark Costs for Your ADU Project

Consult an experienced ADU contractor early in the process to get a rough estimate of project costs. This helps establish your budget without diving into specific design details yet. The goal is to gauge how much you can borrow or pay and ensure your design aligns with your financial limits.

3. Get Referrals and Explore Options

Seek ADU lender referrals from trusted sources such as financial advisors, contractors, or homeowners who have built ADUs. They can direct you to reputable lenders and help you avoid common pitfalls. For non-owner-occupied properties, explore private money lending options, including bridge loans, which don't require equity and are based solely on the project's total cost. Contact us to learn more about private loan options for your ADU project.

4. Choose the Right ADU Loan Program

Research various ADU loan programs, including construction loans, home equity loans, and renovation loans. Consider factors like interest rates, loan terms, and fees. At Alto Builders, we focus on building your ADU, but we recommend speaking with multiple lenders to compare options and choose the best loan program for your needs.

5. Prepare Your Preliminary Loan Application

Gather the necessary documentation for your loan application, including income verification, credit score details, and financial records. Early in the application process, lenders focus on verifying your financial eligibility. ADU-specific details will be evaluated later, so it's essential to have your personal financial documents in order.

6. Kick off ADU Design & Feasibility

Once you've received initial financing approval, begin your ADU feasibility study and design process. Select a licensed builder with ADU experience, as lenders will require contractor information and project specifics. A Feasibility Study will assess your project's viability and provide detailed construction costs needed for the loan. This phase also moves you toward securing construction permits. Learn more about finding the right ADU company.

7. Appraisal and Loan Approval

As your project approaches the permitting stage, your loan details will be finalized. For construction loans, lenders will typically order an appraisal to estimate your property's future value with the completed ADU. Submitting documents like a floor plan, elevations, a detailed scope of work, construction budget, and payment timeline is usually sufficient. If the appraisal aligns with expectations and your financials are in order, the loan will be approved, and the funding process can begin.

8. Loan Disbursement and Monitoring

After loan approval, funds will be disbursed based on your loan program. For HELOCs, funds might be released in one lump sum, while construction loans are disbursed in stages, known as draws, tied to construction milestones. Lenders may require inspections to verify the progress, releasing funds at each stage to ensure the project stays on track.

Explore Your ADU Financing Options

Let's discuss financing solutions that work best for your ADU project and budget.

Get Free ConsultationCheck your City's ADU Regulations

Navigate local requirements with confidence

While the new statewide ADU laws have simplified the process of adding an ADU in California, each city in Ventura County and Los Angeles has its own unique set of regulations. Properly scoping and preparing your ADU project is critical for a smooth permitting experience, potentially saving you from costly delays, resubmissions, and extra fees.

At Alto Builders, we stay up-to-date on the latest ADU regulations across Ventura County and Los Angeles, guiding our clients to navigate these requirements confidently. Our comprehensive feasibility study evaluates all relevant local and state regulations, helping you streamline your project from start to finish.

Find Your City Here

Explore Our ADU Plans & Pricing

Ready-to-build floor plans with transparent pricing

Explore our collection of ready-to-build ADU floor plans below. Simply click on any plan to view detailed pricing. Whether you're looking to customize one of our existing blueprints or dreaming of a fully custom ADU design, we've got you covered.

Our in-house design team specializes in creating plans that integrate seamlessly with your main residence, ensuring your ADU's exterior complements your property. From minor modifications to completely bespoke designs, including stacked ADUs and guest house layouts, we offer a wide range of options to bring your vision to life.

Studio Plans

One Bedroom Plans

Two Bedroom Plans

Need a Custom ADU Design?

Our team can create a completely custom ADU tailored to your specific requirements and property constraints.

Schedule a Consultation